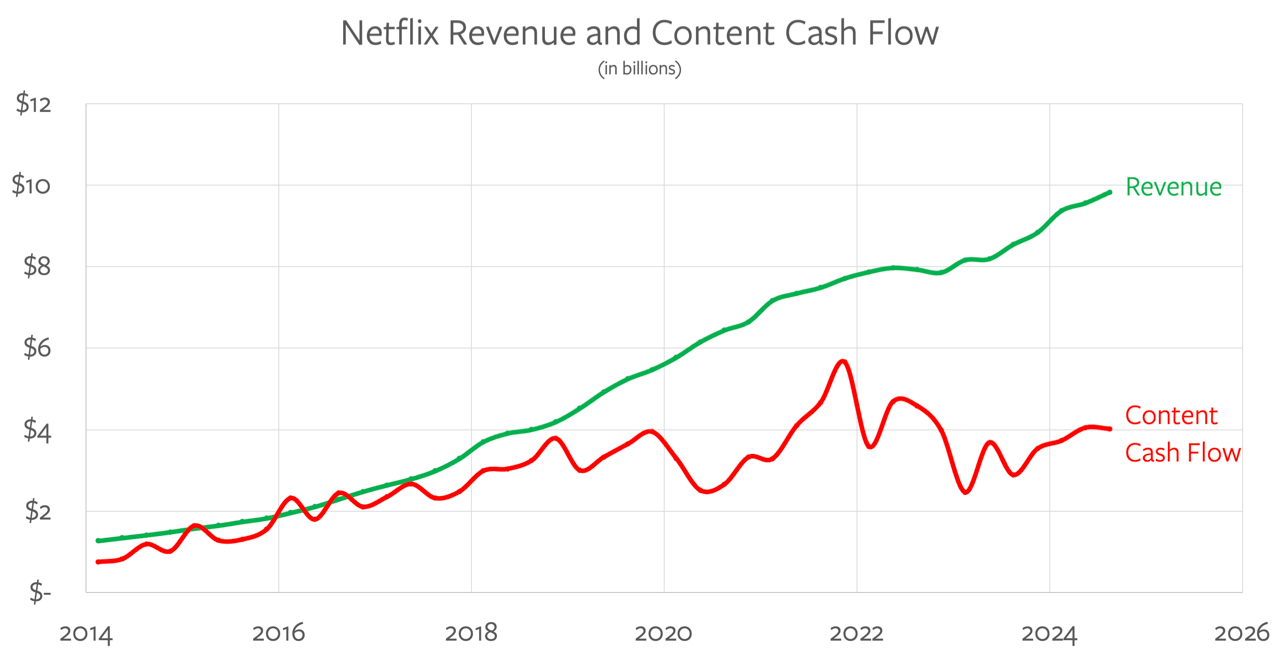

Ben Thompson dissects Netflix’s earnings reports in today’s update, and I absolutely loved this chart, plotting revenue against content cash flow.

For many years Netflix’s investment in content growth tracked its revenue growth; as you can see on this chart, though, the key switchover happened around 2018, when Netflix’s content costs stabilized at around $4 billion per quarter. And, guess what happens when you keep costs steady but revenue continues to grow? You get expanding margins, and you start to look a bit more like a tech company.

Thompson goes on to compare and contrast Netflix’s “pay up front for content” model with YouTube (and Spotify’s) model, where content costs are directly connected to revenue.

YouTube has much more theoretical upside for creators: a hit video can generate millions of dollars on its own. That payout, though, is much less certain; that means the smartest approach is contant production, both to increase the chances of a breakout and also to build up a presence in users’ algorithms that delivers a baseline amount of viewing. That can make for compelling content, to be sure, but Netflix is right that its not really suited for more highly produced high cost offerings.

You can, if you squint, see the classic Internet barbell concept here: on one hand you have a large platform [Netflix] that, thanks to its large user base, can provide funding with a fixed upside to creators; on the other you have a large platform [YouTube] that, thanks to its astronomically large userbase, can provide huge variance in outcomes. One wonders how much room there is in the long run for something in the middle, i.e. the old Hollywood model, where creators could make ambitious projects with a lot of funding and still get a share of the upside. On one hand the companies stuck in the middle need these models, because they need to produce content at a somewhat lower cost; on the other hand, if they keep giving away upside they may never grow big enough to overcome the distribution advantages Netflix has by getting to scale first.